CMT Field Notes: Feiplastic Brazil

It’s a bit of a haul to Sao Paulo from Boston, but with only one hour time difference, a decent sleep on the plane means that you can arrive without too much jet lag. The Feiplastic tradeshow is billed as the largest trade show in Latin America with approximately 70,000 visitors which would make it similar in size to NPE (there were 65,810 attendees in Orlando this year).

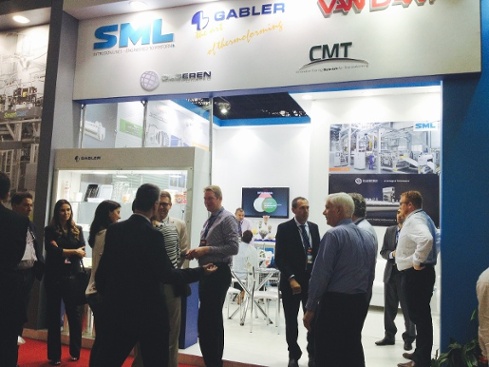

CMT is represented by Equipamentos e Materiais Técnicos Ltda. (EMATEC), a Brazilian company that represents major European and American OEMs to the plastics and packaging industries. With principals from sheet extrusion lines to feedblocks and dies to plug assist materials, EMATEC is well-positioned to comment on the state of the thermoforming industry in Brazil.

Harold Weil, principal at EMATEC, expressed the following when discussing the thermoforming market in Brazil:

“I would say that the market has slowly changed over the past 10 years to the point where we now can see 3 distinct market segments. The first is what we call disposables: high volume, low value parts such as thin PP and PS drinking cups. In this area, Brazilian machinery makers and toolmakers dominate. The second segment is what we call food service: again, high-volume parts that are used by major brands such as McDonalds, Burger King, and other fast food restaurants. In this segment, quality printing is required so we see the use of Van Dam printers and some European thermoforming technologies. Because the local machinery suppliers build cut-in-place machines with blow-off systems, the end-customer can use 90+ cavity tools and achieve the necessary quality. The third segment is what we call industrial packaging: this is where you find very high-quality dairy parts (yogurt, margarine) that require tight tolerances for downstream processing such as filling and sealing. This segment uses European technology almost exclusively.”

Last year, CMT made the decision to switch from a distributor model to a representative model because of notorious difficulties with Brazilian import duties and a maze of taxes and fees. Many of the companies we met during the show were pleased to hear that they can now purchase HYTAC products more efficiently.

Despite the current economic climate in Brazil which led to fewer exhibitors at the show compared to 2013, the halls were generally very busy. Large resin suppliers and chemical companies such as Braskem, Dow, Dupont, etc. all had significant booths which, given the show hours of 11am – 8pm, resembled lively pubs at the end of each day! We counted 4 thermforming OEMs from Brazil, each showing machines. Other OEMs from Europe and the US included Gabler (with Ematec), Illig and TSL / Sunwell Global.

We had several productive conversations with toolmakers and thermoformers, some of whom we met for the first time at this show. Our new HD HYTAC video was a big hit with these companies. Many complained about the poor performance of commodity grade products like Delrin. Frequent burning and cracking caused downtime for thermoformers. Uneven material distribution leads to part failure and customer rejection. Given the inherent material properties of syntactic foam, many of these issues can be eliminated by choosing the right grade of HYTAC that works best for a given application.

We look forwad to working with new customers in Brazil. After all, with 200MM people, the “B” in the BRIC countries is a major player in the world economy.